does california offer renters tax credit

All of the following must apply. Your California income was.

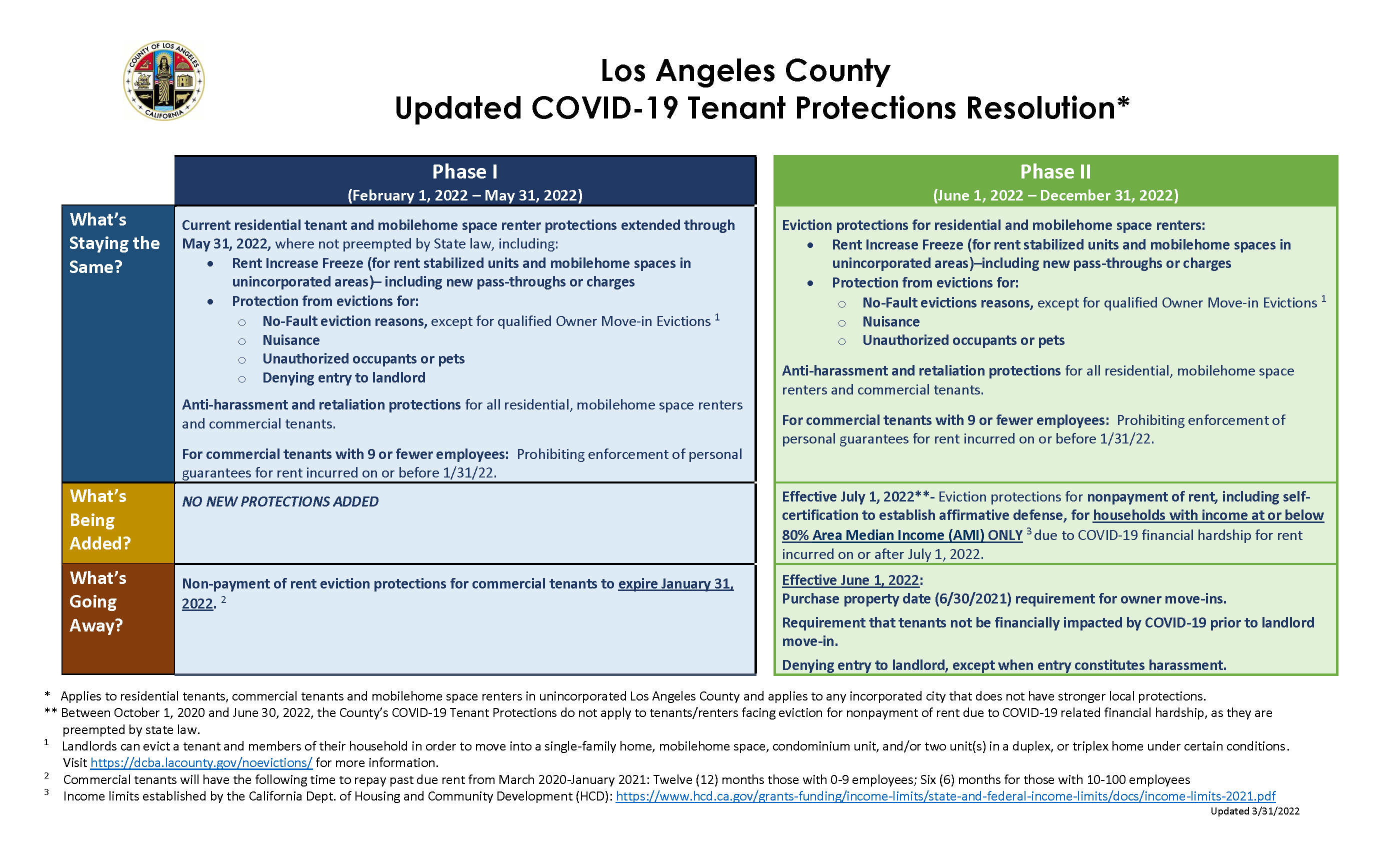

About L A County S Covid 19 Tenant Protections Resolution Consumer Business

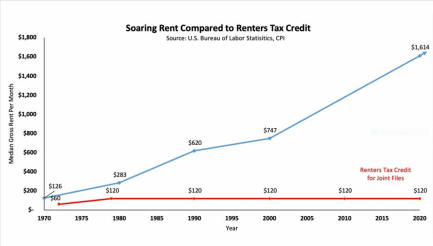

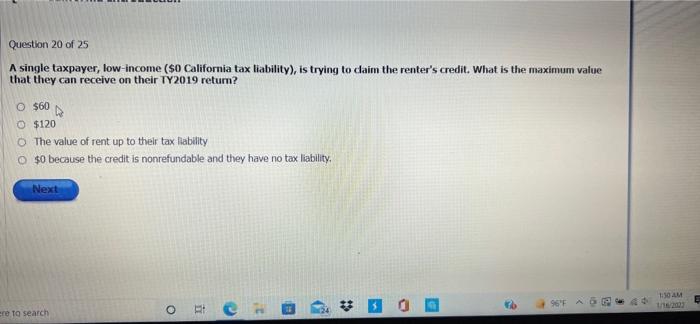

Most Californians who rent their principal residence may claim an income tax credit known as the renters credit which reduces their tax liability.

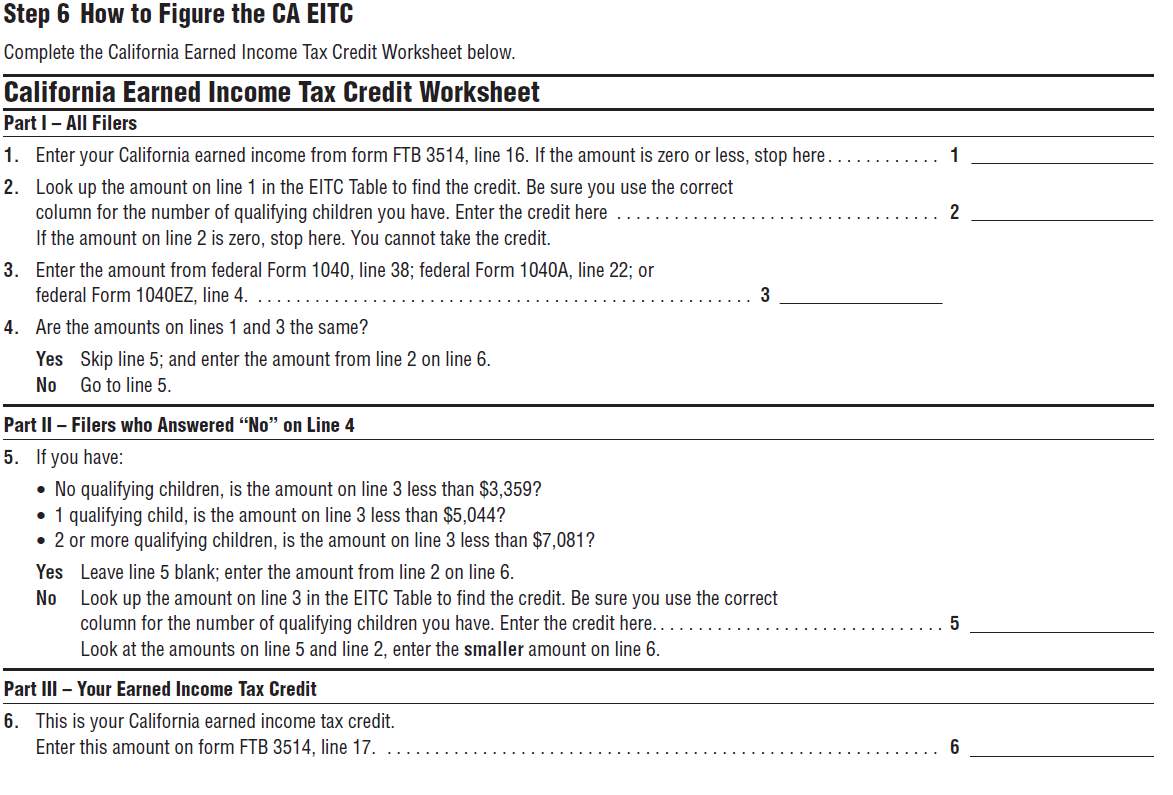

. Here are the states that offer a renters tax credit for based on income. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers. Complete the worksheet in the California instructions to figure the credit.

The property was not tax exempt. A proposal in the state Senate would increase Californias renters tax credit from 60. Tax credits help reduce the amount of tax you may owe.

California allows a nonrefundable renters credit for certain individuals. Renters Credit Nonrefundable. The average lot size on Wintergreen Cir is 4748 ft2 and the average property tax is 133Kyr.

You paid rent in California for at least 12 the year. That is California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters tax credit. The legislation SB 843 would increase the California renters tax credit for the.

Californias renter tax credit has remained unchanged for 43 years. If you rent your home in California for at least six months of the year and make less than 43533 single filer or 87066 filing jointly you are eligible for the annual California. The taxpayer must be a resident.

If youve lived in California for at least half of the year youre potentially eligible for a renters. According to California law. To claim the renters credit for California all of the following criteria must be met.

The maximum credit is limited to 2500 per minor child. It would increase Californias renter tax credit from 60 to 500 for eligible single filers and 1000 for couples as well as single filers with dependent children. More than 3 million Californians with lower incomes could get a break on their taxes under a bill that would significantly increase the credit for renters for the first time in more than 40 years.

If you paid rent for six. 43533 or less if your filing status is single. If you pay rent for your housing have a family with children or help provide money for low-income college students you may be.

In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a tax credit of 60 or 120. It could soon increase.

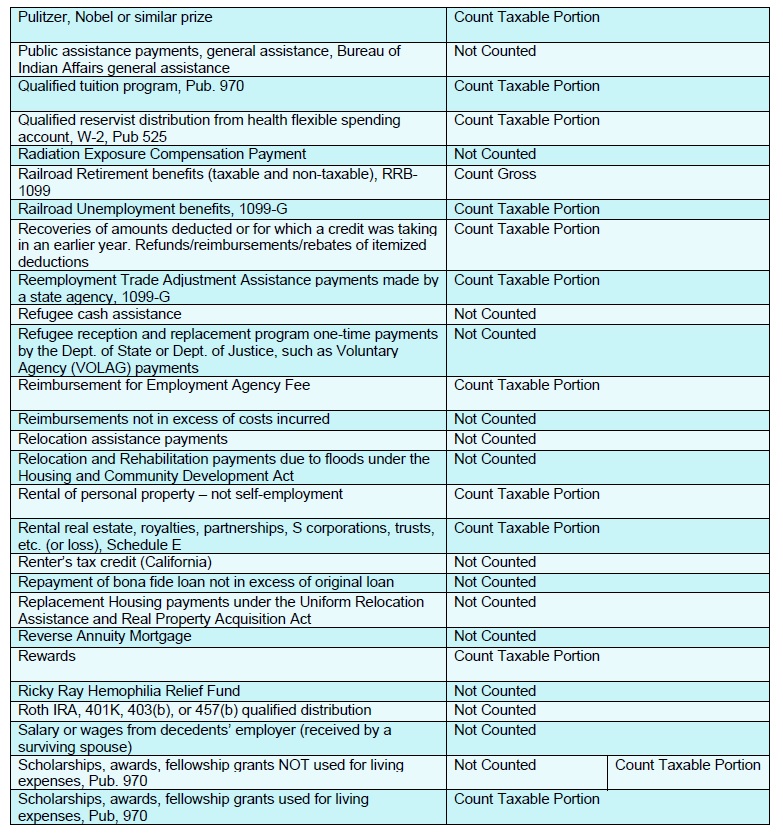

What Type Of Income Is Counted For Covered California Aca Plans

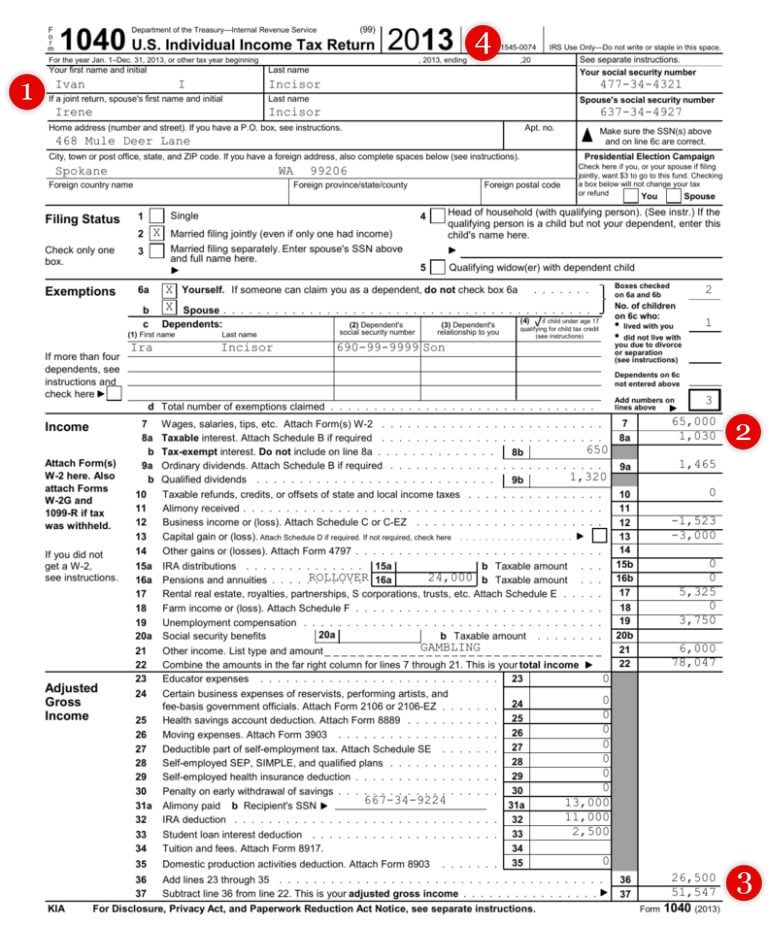

10 Proof Of Income Documents Landlords Use To Verify Income

What Credit Score Do You Need To Rent An Apartment 2022 Bungalow

California Eviction Moratorium Rent Relief Faq Calmatters

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

California Renters Tax Credit May Increase To Up To 1 000

Ca S Renter Tax Credit Could Increase Up To 1k Cbs8 Com

Sharing This Covid19 Rent Relief Nikkei Credit Union Facebook

Tax Deductions For Savvy Bay Area Renters

California Renters Could Get Tax Break Protections From New Bills Daily News

Can A Tax Credit Provide Long Overdue Relief For Renters

Senator Becker Coauthors Bill To Update California S Decades Old Renters Tax Credit To Aid Low Income Residents Senator Josh Becker

Solved Question 20 Of 25 A Single Taxpayer Low Income 0 Chegg Com

Kamala Harris Bill Would Give Renters Monthly Tax Credit

:max_bytes(150000):strip_icc()/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

Property Tax Write Offs For California Landlords

Difference Between Similar Federal And California Credits

Rent Relief In California How To Apply And What You Could Get Kqed